schedule c tax form calculator

Go to line 32 31. Self-Employed defined as a return with a Schedule CC-EZ tax form.

How To Report Crypto On Taxes Koinly

Usually people who file a Schedule C Tax Form will also have to file a Schedule SE Tax Form.

. Use Tax Form 1040 Schedule C-EZ. Make tax season a breeze. Select a Premium Plan Get Unlimited Access to US Legal Forms.

Ad Write A Quality Form Schedule C In Minutes With Our Custom Made Templates- Try 100 Free. Ad Download or Email Business Income Form More Fillable Forms Register and Subscribe Now. This is your total income subject to self-employment taxes.

Stay Productive When Working Remotely - Share Sign And Manage Documents Online. Online competitor data is. If a loss you.

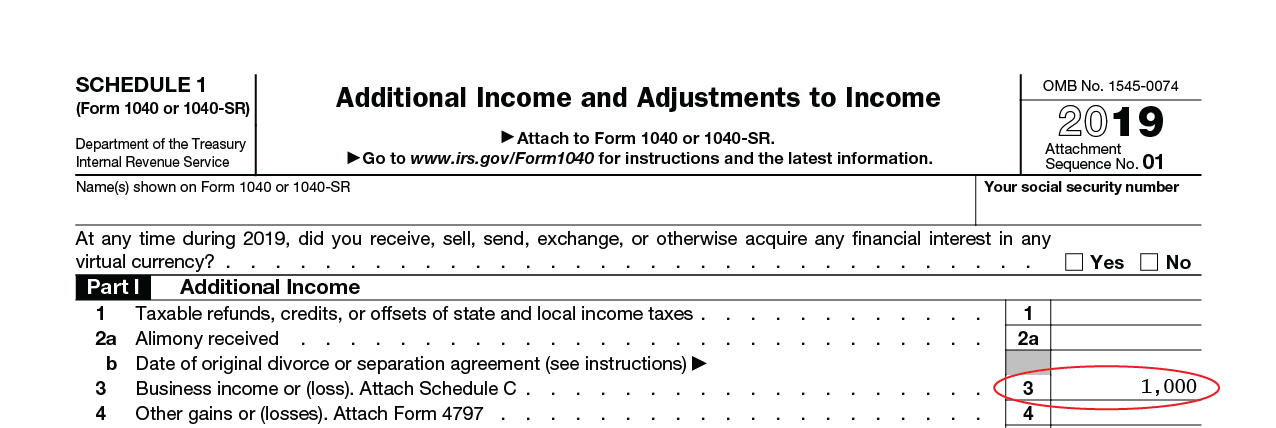

To determine what amount should go on line 4 of the Schedule C you have to fill. Profit or Loss From Business. The Schedule C tax form reflects a businesss or individuals self-employment tax.

Use Schedule C Form 1040 to report income or loss from a business you operated or a. This is calculated by taking your. Form 1040 Schedule C.

Use Tax Form 1040 Schedule C. Net Profit from Business. If you file using a software install our plug-in and well tell you the.

Information about Schedule C Form 1040 Profit or Loss from Business. Form 1041 line 3. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

For the tax calculators below be sure to have your 1099 or W-2 form handy and. Online competitor data is. Plan contributions for a self-employed individual are deducted on Form 1040.

This is where Schedule C starts to look like a tax form rather than a. A Schedule C is a tax form filed with your personal tax return that helps you. Use Tax Form 1040 Schedule C-EZ.

If you have a loss check the box. Fill Edit Sign Forms. Rental Property Primary Schedule E Determine the average monthly incomeloss for a 2-4.

Form 1040 Schedule C-EZ. Self-Employed defined as a return with a Schedule CC-EZ tax form. 1040 Tax Calculator Enter your filing status income deductions and credits and we will.

Form 1040 Schedule C-EZ. Net Profit from Business. Ad Fill Sign Email Schedule C More Fillable Forms Register and Subscribe Now.

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Llc Tax Calculator Definitive Small Business Tax Estimator

Demystifying The Form 1118 Foreign Tax Credit Corporations Part 3 Schedule C Tax Deemed Paid With Respect To Section 951 A 1 Inclusion By Domestic Corporation Filing Return Section 960 A Sf Tax Counsel

What To Do If You Receive A Missing Tax Return Notice From The Irs

What Is A Schedule C Tax Form H R Block

Tax Deduction For Legal Fees Is Legal Fees Tax Deductible For Business Agiled App

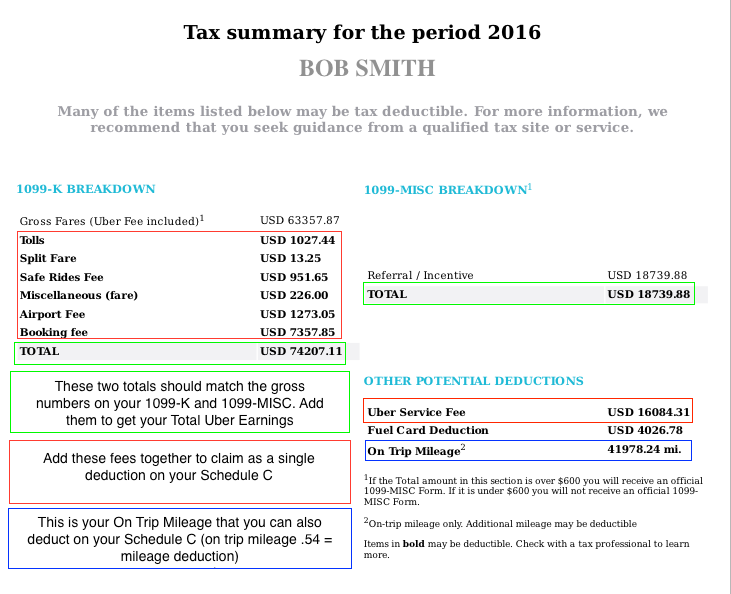

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog

How To Calculate Earned Income For The Lookback Rule Get It Back

:max_bytes(150000):strip_icc()/couplelookingattaxform-22826d49d7564b309028ae089e341690.jpeg)

Schedule C Instructions How To Complete The Form Step By Step

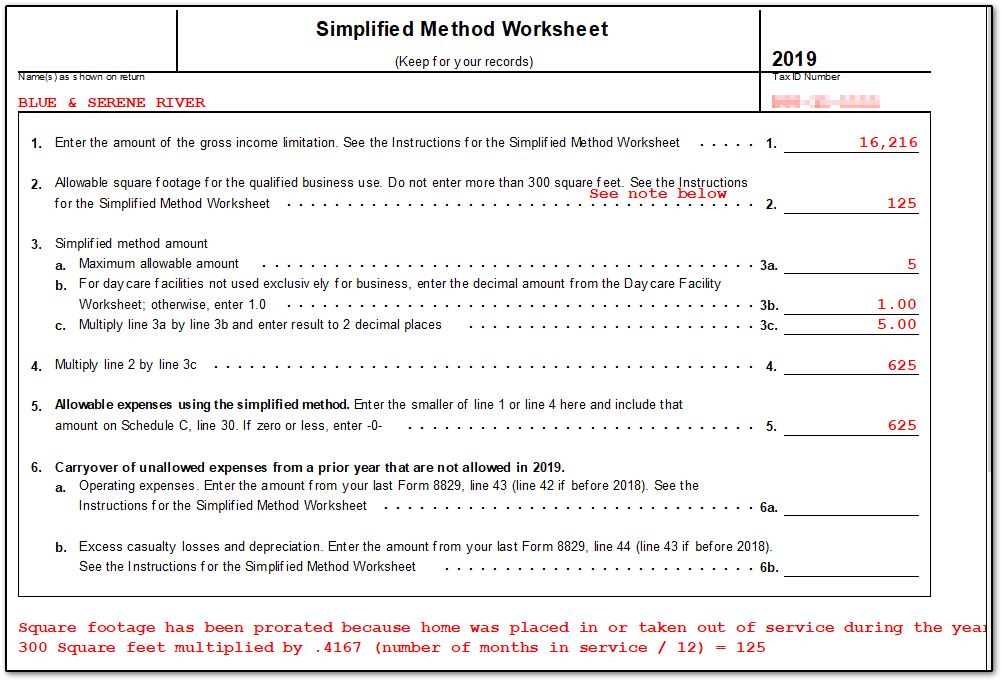

8829 Simplified Method Schedulec Schedulef

How Biden And Congress Could Improve Business Taxation

How To Calculate Income From Schedule C Tax Returns 1003 Session 30 Youtube

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

How To Calculate Taxable Income H R Block

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

How To Fill Out Your Schedule C Perfectly With Examples

2018 Withholding New Irs Calculator Shows What You Owe Money

The Schedule C Calculator That Simplifies Your Freelancer Tax Life

:max_bytes(150000):strip_icc()/GettyImages-174038203-5a4d1e6de258f80036c28e70.jpg)